Organisations are exposed to many operational risks. Major disruptions can be caused by the human factor. This can include mistakes that have severe consequences or internal fraud. When assessing risk, operational risk managers place emphasis on the human element. They also look for failure modes within business units. These failures can result from a lack in compliance, poor competency, and attrition of key staff.

Fraud

Fraud as an operational threat has been a growing concern within the banking sector. The OCC estimates that nearly 40% of large, digital financial services companies will see an increase in fraud between now and 2020. Internal fraud includes asset misappropriation and tax non-compliance. Bribes are also possible. External fraud includes data theft, system breaches and check fraud. The fraud risk is increasing with an increase transaction volume and sophisticated fraud tools that criminals have access to. This is not only costly for banks, it disrupts the operations.

Emerging risks pose challenges for banks and require specialized knowledge. Understanding new vulnerabilities, fraud typologies, first-line processes, and how to manage fraud risk is one example. It also includes oversight of conduct risks, which involves knowledge of gameable systems and nontransparent communications.

System failures

Two major types of operational risk can be classified. First, the risk of a system failing. There are many ways this risk could occur. A system can fail because of power fluctuations. This could cause data to be lost. If this happens, bank transactions or organization financial data can be lost. Another type of system failure is caused by a virus attack, which can damage data or destroy systems completely. A system can also fail because of an external event such as a natural catastrophe or human error.

Organisations with robust business continuity plans are well positioned to address operational risks. Plan for disaster recovery can be included in these plans if the primary system is not available. This plan will take all necessary steps to ensure that the company is operational in the event of a disaster.

Terrorism

Management challenges arise from the operational risks of terrorist acts. Because terrorists are unpredictable, and their behavior changes frequently, it can be difficult to predict what they will do. There are however ways to reduce the risk. The first step is to develop an intelligence capacity. This capability can identify risk factors and help determine risk/reward relations. It can also help to determine the likelihood of terrorist acts. Understanding these parameters allows an organization to be more rational and pragmatic in its response.

Operational risks of terrorism are a growing threat to many countries. Increased globalization, technological changes, and the networked society have made terrorists more vulnerable. These threats can be countered by governments that have the ability to gather intelligence, better understand the threat environment and cooperate with their municipal counterparts. For example, the Canadian Association of Chiefs of Police maintains a Counterterrorism & National Security Committee. It is composed of senior officials from the RCMP of Canada and the provincial and municipal police forces.

Employer compensation claims

Operational risks in the workplace can result in employee compensation claims. These claims can result in significant financial losses for the business. Employers with less experience are more likely than others to sustain an injury or lose a work day. This makes them a good candidate for compensation. A Prime Insurance Company evaluation of operational risks in the workplace can help determine which risks you should consider.

Highly skilled professional claims management positions are responsible to handle unique claims, underwriting claims and analysis of loss exposures. Claims management specialists evaluate the economic impact of a case, devise effective strategies to resolve it, and compile all documentation necessary for awarding benefits. They may testify at court and provide functional expertise.

FAQ

What are management theories?

Management concepts are the practices and principles managers use to manage people or resources. They include such topics as human resource policies, job descriptions, performance evaluations, training programs, employee motivation, compensation systems, organizational structure, and many others.

What is Six Sigma?

Six Sigma uses statistics to measure problems, find root causes, fix them, and learn from past mistakes.

The first step is identifying the problem.

Next, data are collected and analyzed in order to identify patterns and trends.

The problem is then rectified.

Finally, data will be reanalyzed to determine if there is an issue.

This cycle continues until the problem is solved.

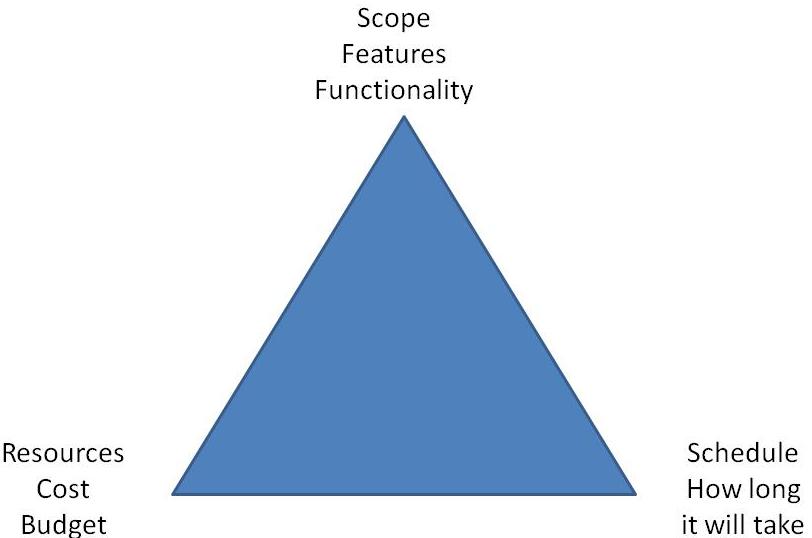

What's the difference between a program and a project?

A project is temporary, while a program lasts forever.

A project has usually a specified goal and a time limit.

It is often carried out by a team of people who report back to someone else.

A program is usually defined by a set or goals.

It is usually done by one person.

Statistics

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- Our program is 100% engineered for your success. (online.uc.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

External Links

How To

How can you use the Kaizen method?

Kaizen means continuous improvement. This Japanese term refers to the Japanese philosophy of continuous improvement that emphasizes incremental improvements and constant improvement. It's a process where people work together to improve their processes continuously.

Kaizen is one of Lean Manufacturing's most efficient methods. This concept requires employees to identify and solve problems during manufacturing before they become major issues. This will increase the quality and decrease the cost of the products.

Kaizen is an approach to making every worker aware and alert to what is happening around them. It is important to correct any problems immediately if they are discovered. Report any problem you see at work to your manager.

Kaizen follows a set of principles. When working with kaizen, we always start with the end result and move towards the beginning. In order to improve our factory's production, we must first fix the machines producing the final product. We then fix the machines producing components, and the machines producing raw materials. Then we fix the workers, who directly work with these machines.

This method is known as kaizen because it focuses upon improving every aspect of the process step by step. Once we have finished fixing the factory, we return to the beginning and work until perfection.

It is important to understand how to measure the effectiveness and implementation of kaizen in your company. There are several ways to determine whether kaizen is working well. Another method is to see how many defects are found on the products. Another method is to determine how much productivity has improved since the implementation of kaizen.

A good way to determine whether kaizen has been implemented is to ask why. It was because of the law, or simply because you wanted to save some money. It was a way to save money or help you succeed.

Suppose you answered yes to any of these questions, congratulations! You're ready to start kaizen.